- Which jurisdictions are offshore ones?

- Are all offshore jurisdictions alike?

- Are incorporation costs the defining criterion for the choice of an offshore jurisdiction?

- Tax rates

- Is it true that classic offshore jurisdictions are easier to work with? Why do we need non-classic jurisdictions then?

- The main advantage of low-tax jurisdictions

- Double taxation agreements

- Prospects of opening a bank account

- A company and an account in the same jurisdiction

- Confidentiality

- Registers of beneficial owners in offshore jurisdictions

- If I set up a company in an offshore jurisdiction, should I be interested in office rent prices?

- What is economic substance in an offshore jurisdiction?

- Do all offshore jurisdictions have economic substance requirements?

- If a jurisdiction has rules for economic substance, is every offshore company required to have it?

- Will a desk rented in an open-plan office count as economic substance?

- What if the jurisdiction does not have economic substance legislation?

- At least classic offshore territories are exempt from financial reporting, are they not?

- Financial statements of an offshore company for a bank

- Reputational risks associated with an offshore company

- Can I use an offshore company for licensable activities?

- Offshore jurisdictions and financial activities

- Offshore jurisdictions and cryptocurrencies

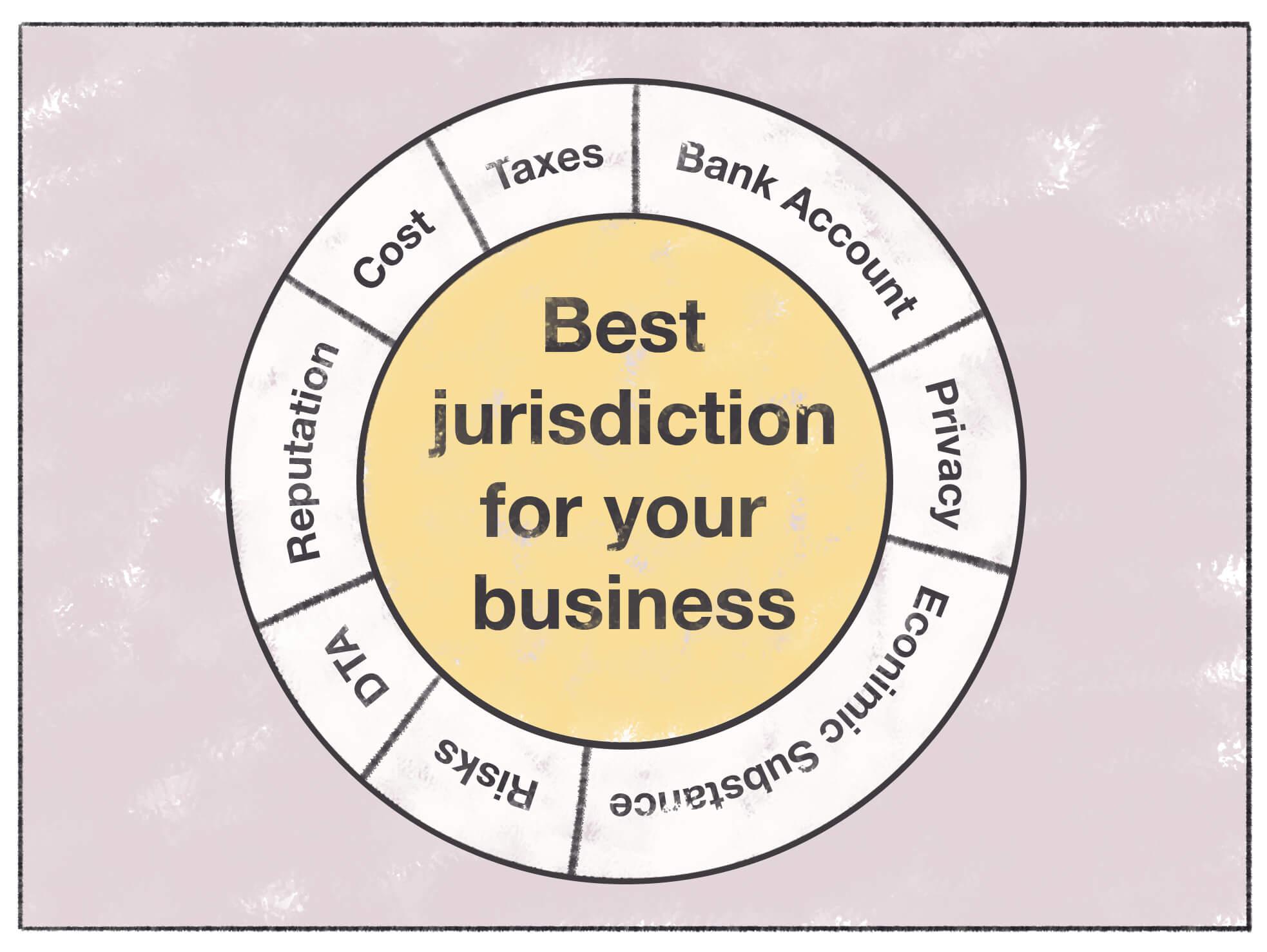

- Which offshore jurisdiction is the best?

Which jurisdictions are offshore ones?

In the most basic sense, an offshore jurisdiction is one where companies are not required to file financial statements with government authorities and are exempt from taxation unless they do business locally. Such offshore jurisdictions of the “classic” type include, among others, the British Virgin Islands, Seychelles, Cayman Islands, and Belize.

However, in everyday use, the word “offshore” also applies to low-tax jurisdictions which are states and territories where companies are required to file financial statements, but enjoy preferential tax treatment. The most famous of these are Cyprus, Hong Kong, and the United Arab Emirates.

Are all offshore jurisdictions alike?

No, they are not, as explained in the previous section. The main distinction is between classic and non-classic offshore territories, however, differences between individual jurisdictions within each of the two groups can also be very significant. The difference between a BVI company and a Belize company is not that big, but the difference between, say, Cyprus and Hong Kong will be quite pronounced. Whereas a Cyprus company and a Belize company, in turn, are two completely different structures, each having a number of important peculiarities.

Are incorporation costs the defining criterion for the choice of an offshore jurisdiction?

No, they are not. Even when forming a company in an “expensive” jurisdiction, incorporation costs as such will only be a small part of your total spending. Your primary focus should be on how efficient and convenient the registered structure will be when it is subsequently used in your business.

Tax rates

This is one of the most important factors to consider when choosing the offshore jurisdiction to set up your project in. Not all offshore zones have 0% tax rate. Such regulation is primarily adopted in classic offshore jurisdictions. Non-classic offshore territories do have a requirement to pay taxes, and the applicable rates may vary. Some of them, such as Singapore, apply a territorial principle of taxation: taxes are only levied on income received in the territory of the country.

Is it true that classic offshore jurisdictions are easier to work with? Why do we need non-classic jurisdictions then?

This question seems self-evident, but the answer to it is not so obvious. It depends on the aspect in which we assess “easy” or “difficult” in relation to a jurisdiction. If we are talking about compliance with basic requirements for the incorporation and administration of a legal entity, then classic offshore companies really have advantages over their non-classic counterparts. However, that statement does not capture all the nuances. For example, no offshore jurisdiction can incorporate a company faster than Hong Kong does – in just an hour. Nor is the cost of incorporating a classic offshore company always significantly lower than incorporation in a low-tax jurisdiction.

The main advantage of low-tax jurisdictions

When choosing between classic and non-classic offshore territories, you first need to understand that a company from an island jurisdiction will have much harder time opening a bank account. You will be asked more questions and requested to provide more documents, your counterparties and the origin of your funds will be checked more carefully – and some financial institutions (both banks and payment systems) will reject your application right away. Your business’ registration in a classic offshore jurisdiction is always going to be an additional risk factor in the eyes of a compliance team.

Are classic offshore jurisdictions really that easy?

The time when you could buy a BVI or Seychelles company “off the shelf” and forget about its administration until the next renewal date is gone. In the current regulatory environment, companies incorporated in classic offshore jurisdictions are obliged to comply with a number of requirements that create additional administrative burden and costs. The latter, in some cases, can be considerable.

If things are so complicated now, are offshore jurisdictions still relevant?

Of course, they are. They have become more difficult to use and maintain, but they still offer tax, currency and corporate advantages that may be of interest to you and your business.

Does it matter in which countries my company will do business?

Naturally, it does. This affects the tax consequences, as well as your chances of opening a bank account.

Double taxation agreements

When choosing a low-tax jurisdiction, it is important to know whether it has a double taxation agreement with the country or countries where the company will conduct business and generate income. Such agreements give companies the right to set off taxes already paid in one country against taxes due in another.

Prospects of opening a bank account

When incorporating an offshore company, it is crucial to know that you will be able to open and freely use a business account for it. Without an operational account, the company’s capacity (and its effectiveness for your business) will be extremely limited. What risk level does the particular jurisdiction present for banks? If the bank has additional requirements, does the jurisdiction offer good options to comply with them?

A company and an account in the same jurisdiction

It may seem counterintuitive, but not all jurisdictions are ready to open bank accounts for offshore companies incorporated in their territory. As a rule, local banks focus on companies operating in the local market. This principle is most strictly adhered to in classic offshore jurisdictions: we had a case where not a single BVI bank agreed to open an account for a company holding a BVI financial licence which is rather difficult to get. In low-tax jurisdictions, it will be easier to open an account at the place of incorporation, but nowhere will this procedure be easy, let alone automatic.

Example: Hong Kong vs. BVI

To open a BVI account, a BVI company must really conduct business in this jurisdiction. In other words, it must have an office, employees, and counterparties in the BVI. Compliance with all these conditions effectively eliminates the company’s offshore status and makes it liable to BVI tax.

To open a Hong Kong bank account for a Hong Kong company, on the other hand, you will only need to: confirm that your business is connected with the Asia-Pacific region (not necessarily with Hong Kong) and that your annual turnover will exceed USD 1,000,000, and pass due diligence procedures standard for Hong Kong banks, which includes the director visiting the bank’s branch for a personal interview.

Confidentiality

One of the traditional advantages of offshore jurisdictions is the confidentiality of information about the beneficial owners of companies incorporated in these jurisdictions. However, over the past ten years, the confidentiality regime has undergone significant changes the scale and nature of which vary from territory to territory. They are important to keep in mind when choosing the best offshore jurisdiction for your business.

Do classic offshore zones guarantee complete anonymity of your company’s beneficial owner?

No, they do not. To begin with, when incorporating any company in any jurisdiction, you are required to provide the details of beneficial owner to the company’s administrator (secretary or registered agent). Until recently, the data of beneficial owners of offshore companies was only kept by their administrators and was not shared with government agencies. However, virtually all major offshore territories have since introduced a requirement to file beneficial ownership information with a state register.

Registers of beneficial owners in offshore jurisdictions

The general principles in the laws on beneficial ownership registers in different jurisdictions are similar. As a rule, they require the company’s registered agent or service provider to collect certain data about beneficial owners (full name, date and place of birth, residential address, and nationality) and submits it to a government agency. But how this data is then kept and whether it is accessible may vary.

Is the register of beneficial owners of offshore companies a publicly accessible Internet website?

Not always. Some non-classic jurisdictions such as the UK indeed make the data of beneficial owners of all UK companies available to everyone on a free website. However, most of the other jurisdictions give access to beneficial ownership registers to government authorities only.

Are there offshore jurisdictions without state registers of beneficial owners?

The trend to have unified registers is global in nature and is actively promoted by major international organizations, therefore all major jurisdictions currently have a requirement to file beneficial ownership data with the state register.

What about registers of directors?

The details of directors are filed with public registers in almost all jurisdictions. Most of them make this information publicly accessible.

If I set up a company in an offshore jurisdiction, should I be interested in office rent prices?

You might often have to be. There are a number of factors that determine the need to set up a physical office and the level of cost of maintaining it. First of all, a number of offshore jurisdictions have statutory requirements for the economic substance (physical presence) of companies.

What is economic substance in an offshore jurisdiction?

In the most general terms, economic substance means all signs of the existence and operation of a business that go beyond the registration paperwork: an office, hired employees, and expenses in the country of incorporation. Having economic substance distinguishes a real company from a “shell company” that only exists on paper.

Do all offshore jurisdictions have economic substance requirements?

No, but these requirements exist in most of the classic offshore territories, as well as in the UAE.

If a jurisdiction has rules for economic substance, is every offshore company required to have it?

No. Economic substance requirements depend on what the company does. The legislation of each jurisdiction provides its own list of activities which require confirmation of economic substance. These normally include licensable activities (banking, insurance, financial and leasing activities), cargo transportation, and IT sphere. Therefore, if you are going to engage in any of these businesses, you need to take into account the cost of creating economic substance.

Will a desk rented in an open-plan office count as economic substance?

We would not bet on that. The scope of economic substance should be adequate to the scale of the company’s operations. Presumably, the larger turnover you generate, the bigger material base and staff you need to have in order to support it. However, holding companies usually enjoy some exemptions: their registered office address counts as sufficient economic substance.

What if the jurisdiction does not have economic substance legislation?

This does not mean that you definitely will not need to rent an office. Even if such requirements are not set by law as, for example, in the Seychelles, many banks do not open accounts to companies without a physical office.

UAE: economic substance in practice

Banking practices must be taken into account when organizing your economic substance. For example, a UAE banker will insist on visiting your office, and upon arrival, will look for a signboard indicating that the premises belong to your company.

Cyprus: economic substance in the absence of legislative requirements

Cyprus – a classic example of a non-classic offshore jurisdiction – does not have economic substance legislation of its own. However, in order to open a Cyprus bank account, you will need to confirm that your company has employees and a physical rented office in the country.

At least classic offshore territories are exempt from financial reporting, are they not?

Not exactly and not always. To begin with, any offshore jurisdiction requires companies to keep records, albeit in an arbitrary form and without filing financial statements with government authorities. Recently, however, some offshore zones have begun to introduce the requirement for maintaining accounting records and keeping underlying documentation.

Seychelles: accounting records keeping

The Seychelles is a classic offshore jurisdiction and does not require companies to submit financial statements to the tax authority. However, the jurisdiction has introduced a requirement to keep accounting records: every company has a duty to retain all financial documents (invoices, contracts, bank statements, waybills, etc.) for 7 years and regularly draw up Financial Summaries – concise reports on the status of its funds. In order to correctly put together such a Summary, you will likely have to do practically the same work as for the preparation of ordinary financial statements.

Financial statements of an offshore company for a bank

Practice may vary in different institutions, but many banks, when opening an account and conducting regular compliance checks, request companies from classic offshore jurisdictions to provide financial statements prepared in accordance with international standards. The record keeping standards (extremely low) established in the country of incorporation are effectively irrelevant in this case. That is why, even if your company is domiciled in the BVI or in Panama, you may still have to prepare financial statements.

Reputational risks associated with an offshore company

They are closely connected with the factors described above. Most organizations and institutions, primarily financial ones, see classic offshore zones as higher risk. Due to their media coverage (especially in journalist investigations like the Panama Papers, Pandora Papers, Bahamas Leaks and others), classic offshore companies are often associated with illegal activities, even if your company is used purely legally.

Most of the low-tax (“non-classic” offshore) jurisdictions are not met with such an attitude. However, they can also be included in black and grey lists of international organizations.

Can I use an offshore company for licensable activities?

Yes, you can, but the practicality of incorporation in a particular jurisdiction will depend on many individual factors.

Offshore jurisdictions and financial activities

It is indeed easier and cheaper to obtain a financial licence in a classic offshore jurisdiction than in any non-offshore one. However, operating such a structure will have its own peculiarities. First of all, there are difficulties in finding payment solutions. We had a case when a company with a financial licence issued by a classic offshore jurisdiction, after several rejections, did get an account, but only on condition that it would not take client funds in it. Naturally, such a solution was of extremely low benefit to the company.

Offshore jurisdictions and cryptocurrencies

As with traditional financial activities, the risks often outweigh the benefits. Jurisdictions where cryptocurrency operations are not licensed do exist, but it is nearly impossible to open a bank account for such a company. It will be much more efficient to register a company and apply for a licence in a jurisdiction that does not belong to classic offshores. Which one it is will depend on your budget, geography of business, direction of cash flows and other factors.

Which offshore jurisdiction is the best?

Unfortunately, there is no single correct answer to this question. The choice of organizational structure for doing business is always determined by the characteristics of the business itself, and the best solution in one case will not necessarily be any good in another. For international business, the number of factors to consider is significantly larger, and offshore specifics add a whole bunch of legal and tax aspects to the list.

Our experienced specialists will be happy to analyse your needs and goals in order to choose an offshore structure that is best for you.